Lifetime Gift Tax Exclusion 2025 Irs

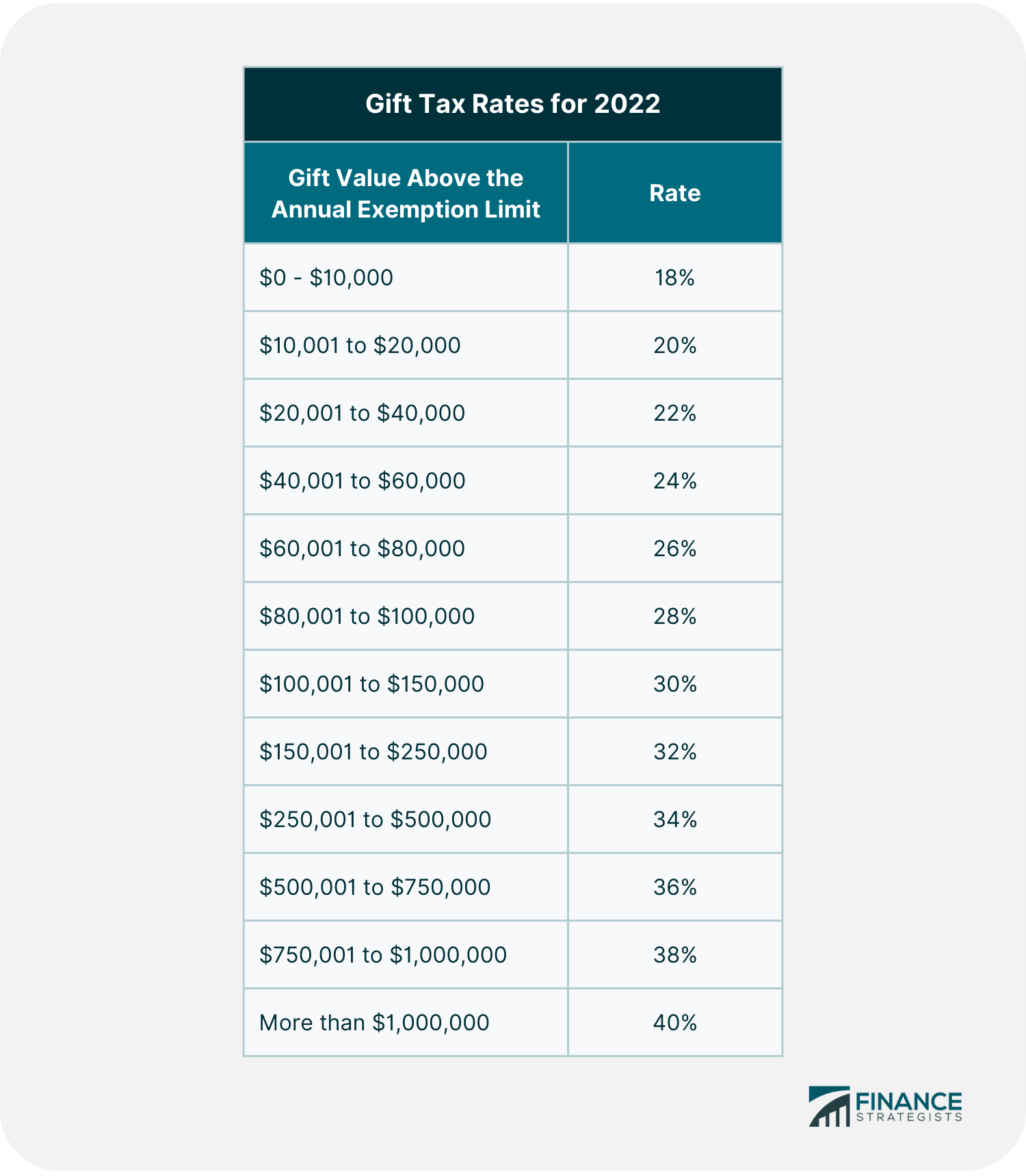

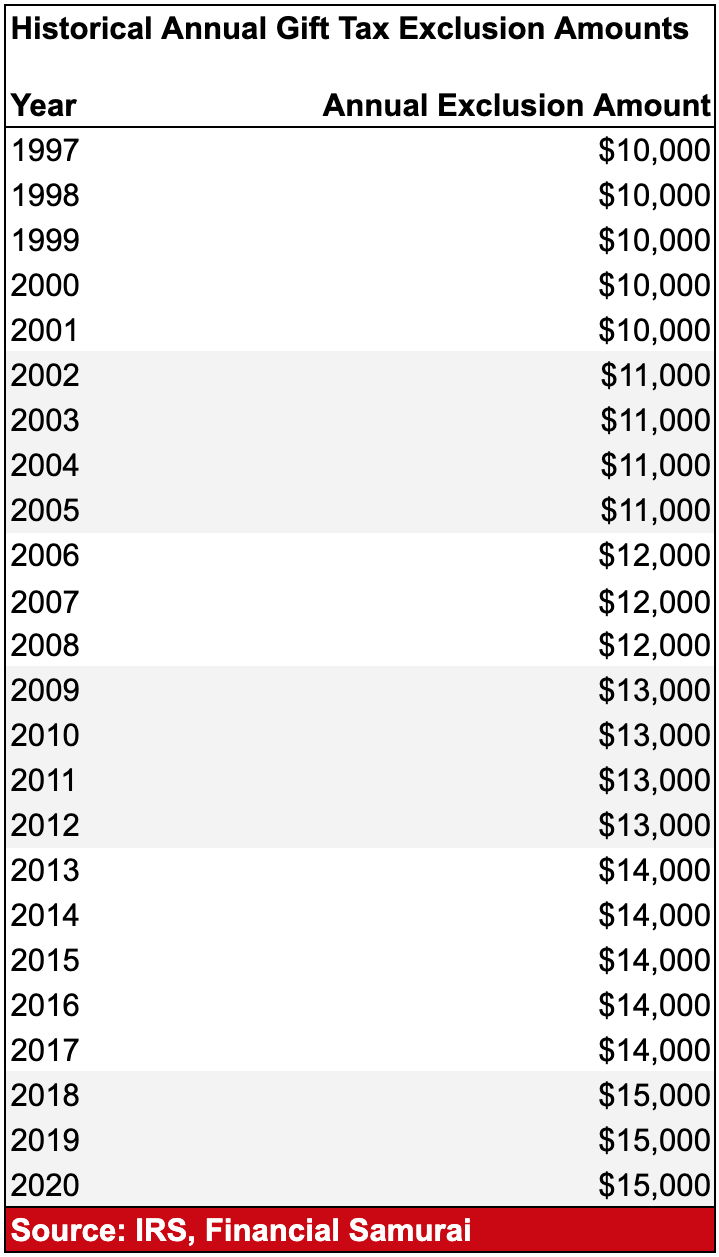

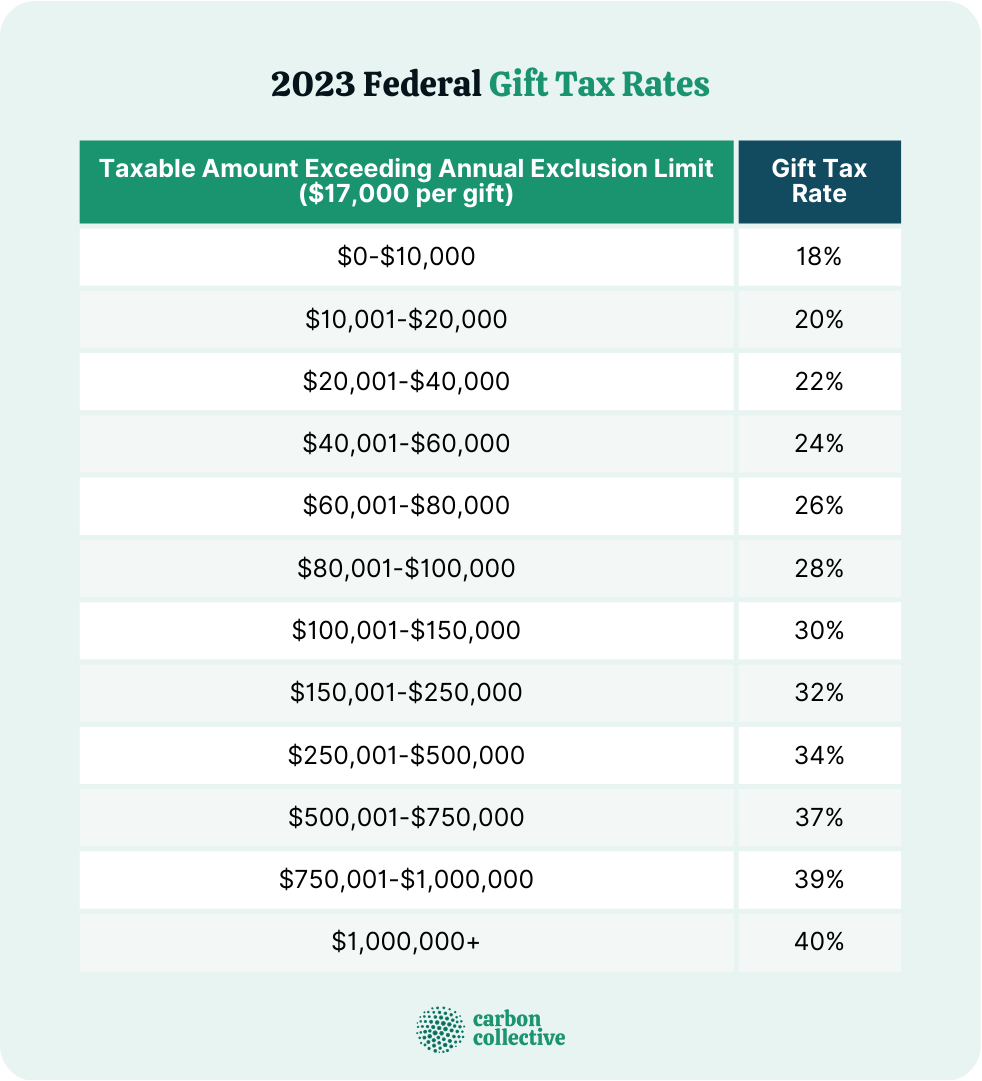

Lifetime Gift Tax Exclusion 2025 Irs. For 2025, the internal revenue service (irs) allows individuals to make gifts of up to $18,000 per year to an unlimited number of. For 2025, you can give up to $18,000 to each recipient without triggering the gift tax, which is known as the annual gift tax exemption.

In one year without filing a gift tax return. This means that you can give up to $13.61 million in gifts throughout your life without ever having to pay gift tax on.

Annual Gifting For 2025 Image to u, — the lifetime exemption is the total amount an individual can give away over their lifetime without incurring gift tax.

Lifetime Gift Tax Exclusion 2025 Irs Florry Petrina, — concurrently, annual gifting leverages the irs’ exclusion amounts, currently $18,000 per recipient ($36,000 per couple), to systematically reduce an estate’s taxable.

Gift Tax Exclusion 2025 Irs Roxie Clarette, Starting on january 1, 2025, the annual exclusion on gifts will be $18,000 per recipient (up from.

Irs Gift Tax Exclusion 2025 Isabel Arlinda, In 2025, that means you can fund a 529 with.

Lifetime Exclusion Gift Tax 2025 Kirby Merrily, But because the tcja sunsets on december 31, 2025, the estate.

Lifetime Gift Tax Exclusion 2025 Irs Quinn Carmelia, — the 2025 gift tax limit (also known as the gift tax exclusion) increased to $18,000 this year from $17,000 last year.

Irs Gift Tax Exclusion 2025 Ivie Rhodie, The irs has announced that for 2025, the federal lifetime gift and estate tax exemption amount will increase to $13.61 million per person.

Lifetime Gift Tax Exclusion 2025 Irs Peg Martguerita, — for 2025, the annual gift tax exclusion is $18,000, meaning a person can give up to $18,000 to as many people as he or she wants without having to pay any.

Lifetime Gift Tax Exclusion 2025 Irs Florry Petrina, — individual taxpayers may also make gifts up to $18,000 per gift recipient (up to $36,000 per recipient for married couples) in 2025 without using any of their lifetime.

Lifetime Gift Tax Exclusion 2025 Irs Quinn Carmelia, In 2025, that means you can fund a 529 with.